If you’re of college-going age, we’re willing to bet you’ve heard all about the benefits of going to college – especially if the people in your life know that you’re on the fence.

Sadly, the vast majority of people still subscribe to the conventional wisdom that going to college is the most direct route to a successful career. What gets far less attention is the benefits of not going to college.

That’s why, below, we’ve rounded up a collection of the benefits of opting out of college.

Take the Road Less Traveled

Did you know that around the world, 30% of students only go to college because they think it’s “what they’re supposed to do after high school”?

That’s a whole lot of high school graduates that didn’t weigh the downsides of college against the actual benefits of not going to college.

Don’t get us wrong, opting out of college without a plan is not the best idea. But choosing to take the road less traveled and forge your own path makes ten times more sense than taking the college route just because “you’re supposed to.”

Following your own path and discovering what excites you is far more likely to lead to a career you don’t hate and a life you love.

Top 10 Benefits of Not Going to College

Below, we’ve rounded up the top ways you’ll benefit from opting out of college.

1. You’ll Save a Lot of Money/Avoid Debt

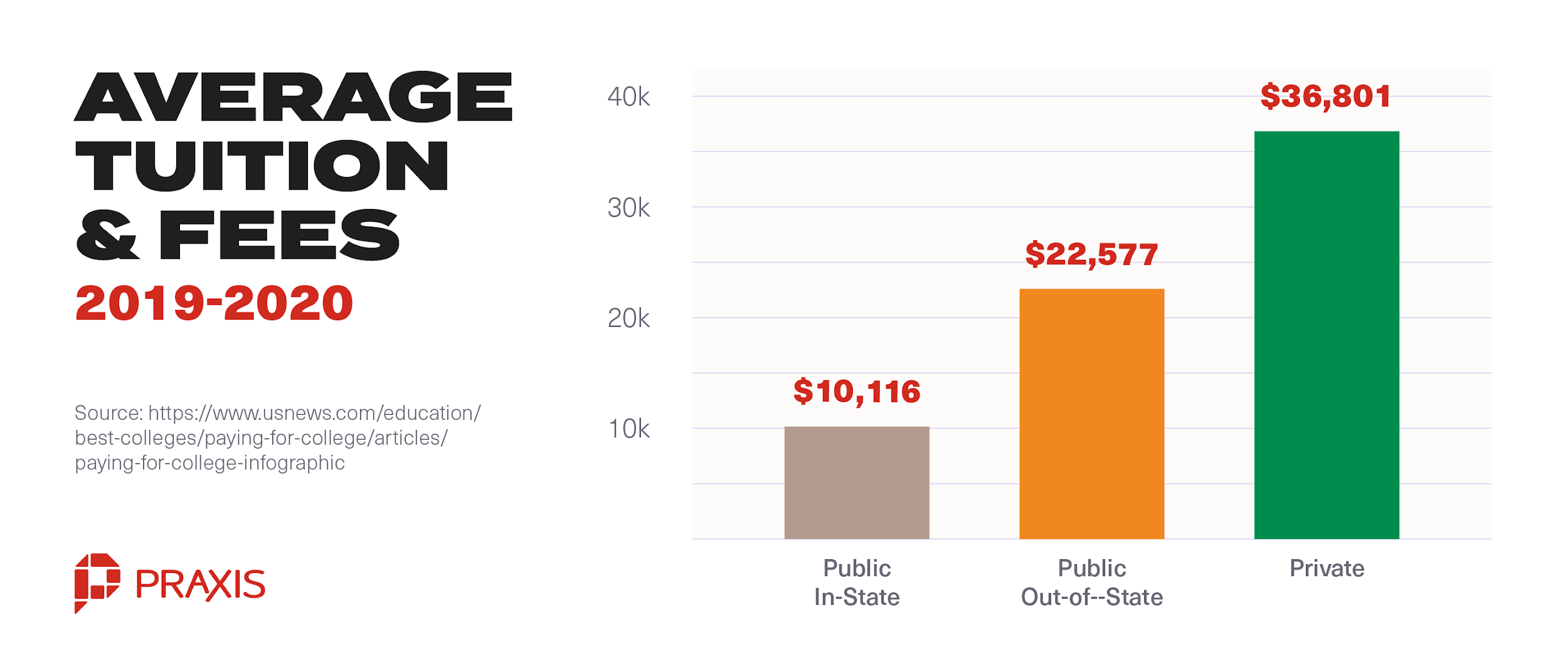

College is expensive. Private college tuition costs $36,801 per year on average, with more than 120 private colleges charging in excess of $50,000 per year. Even public college can set you back $22,577 per year on average for out-of-state and $10,116 in-state. And that’s just tuition and fees, without factoring in costs like accommodation, food, and textbooks.

That means that four years of college at an out-of-state public college will easily set you at least $100K.

If you have to take out loans to pay for college, you end up paying far more because of interest.

The average college graduate with loans owes $32,731 at 5.8% interest. If paid off over ten years at $360 per month, that translates into $43,212. But wait, it gets worse. Research shows that the average graduate takes 21 years to pay off their loans, which means that a $32,731 loan at (5.8% interest) actually ends up costing $55,376.

Not having debt means you reduce your minimum viable income, which gives you a lot more freedom and lower risk, putting you in a position to experiment and test different jobs and ideas without worrying too much about the consequences of a misstep.

Student loan debt also often causes graduates to delay key milestones including homeownership, marriage, and having children.

2. You Can Earn Money Instead

If you skip college, you’ll not only save money and avoid debt, but you’ll also have four years to earn money instead. Whether you get a job, start a business, learn a trade, or monetize your hobby, you’ll have a four-year headstart on your peers that took the college route.

If you’re worried that you won’t make decent money if you don’t go to college, check out this list of 125 Successful People Who Didn’t Graduate College.

3. You Could Increase Your Lifetime Investment Earnings by $1.5 million

You’ve probably heard the argument that college graduates earn about $1 million more in lifetime earnings than individuals with just high school.

Now, setting aside the fact that correlation and averages don’t have much real bearing on the individual, there’s an easy way you could even the score and even outperform that college graduate’s lifetime earnings.

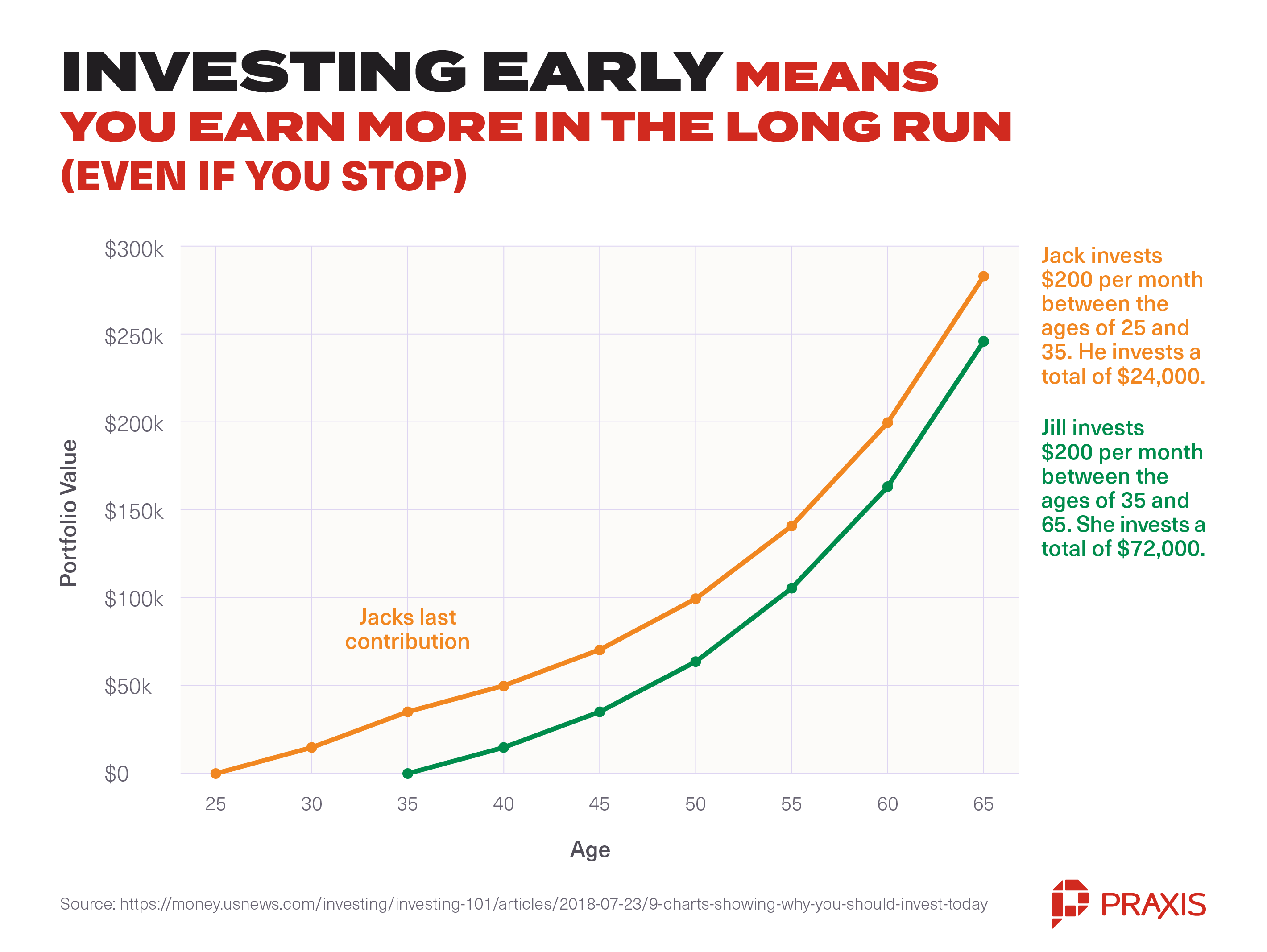

If you start earning money right out of high school and start investing early, you can get a massive head start on someone who only starts investing five years later, after graduating (not to mention those with student loans who only start investing much later).

Here’s an example: If you start putting $500 away each month, your investment could yield $4.7 million by the time you’re 63. Meanwhile, if your friend who went to college only starts investing $500/month five years later, they would end up with $1.5 million less at age 63.

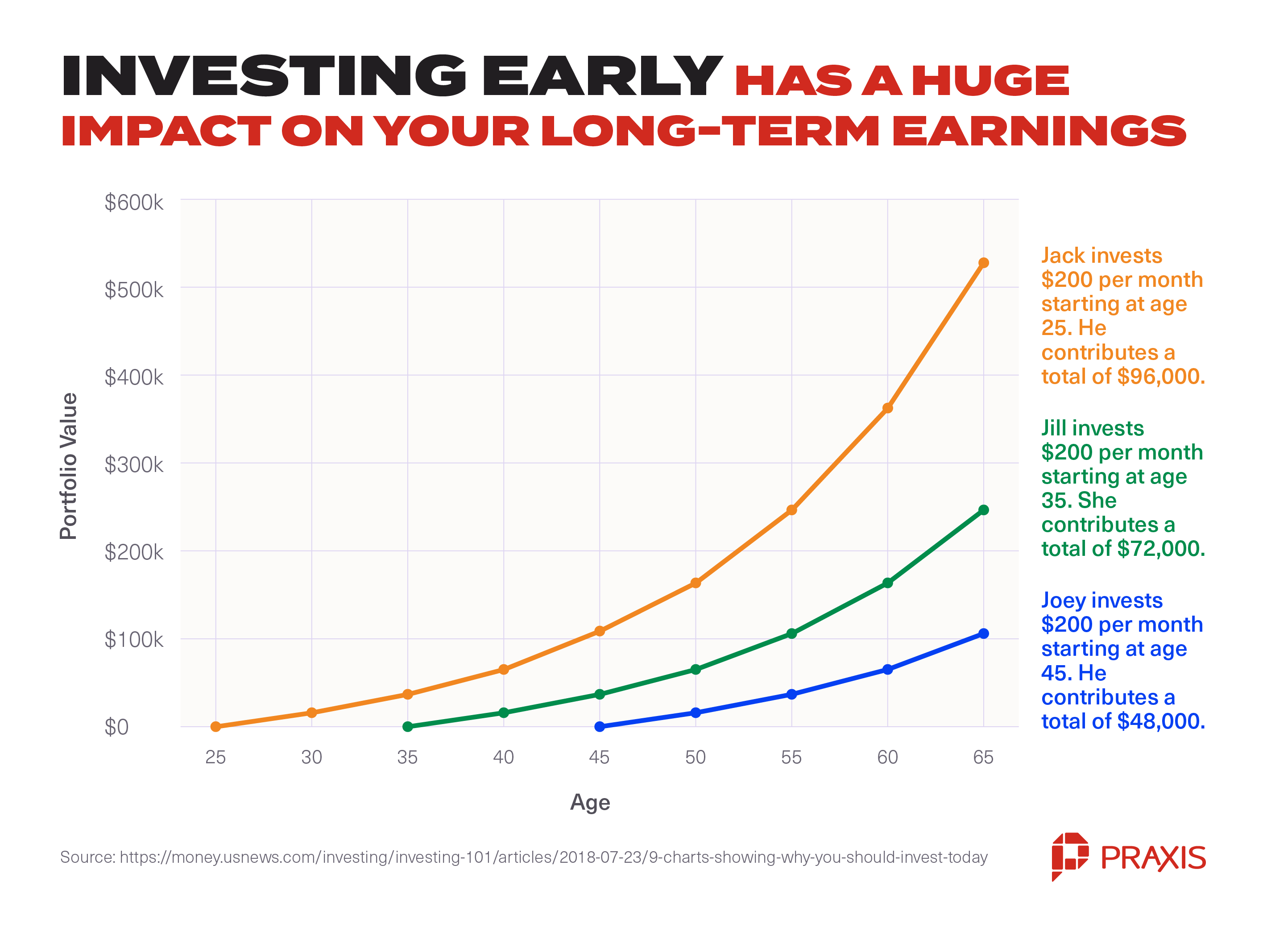

Does $500 seem like a lot? Let’s try with $200 a month:

Jack, Jill, and Joey each invest the same amount each month, but Jack starts at age 25, whereas Jill starts 10 years later, and Joey starts ten years after her. The outcome? Joey more or less doubles his investment by age 65, Jill more than triples hers, and Jack grows his five-fold.

Jack, Jill, and Joey each invest the same amount each month, but Jack starts at age 25, whereas Jill starts 10 years later, and Joey starts ten years after her. The outcome? Joey more or less doubles his investment by age 65, Jill more than triples hers, and Jack grows his five-fold.

Here’s the crazy part: Even if Jack had stopped investing his $200/month at age 35, he would still end up making more than Jill would if she continued investing from age 35-65 (and invested 3 times as much money in total).

The bottom line? The earlier you start investing, the more your lifetime investment income will be.

4. You’ll Stand Out to Employers

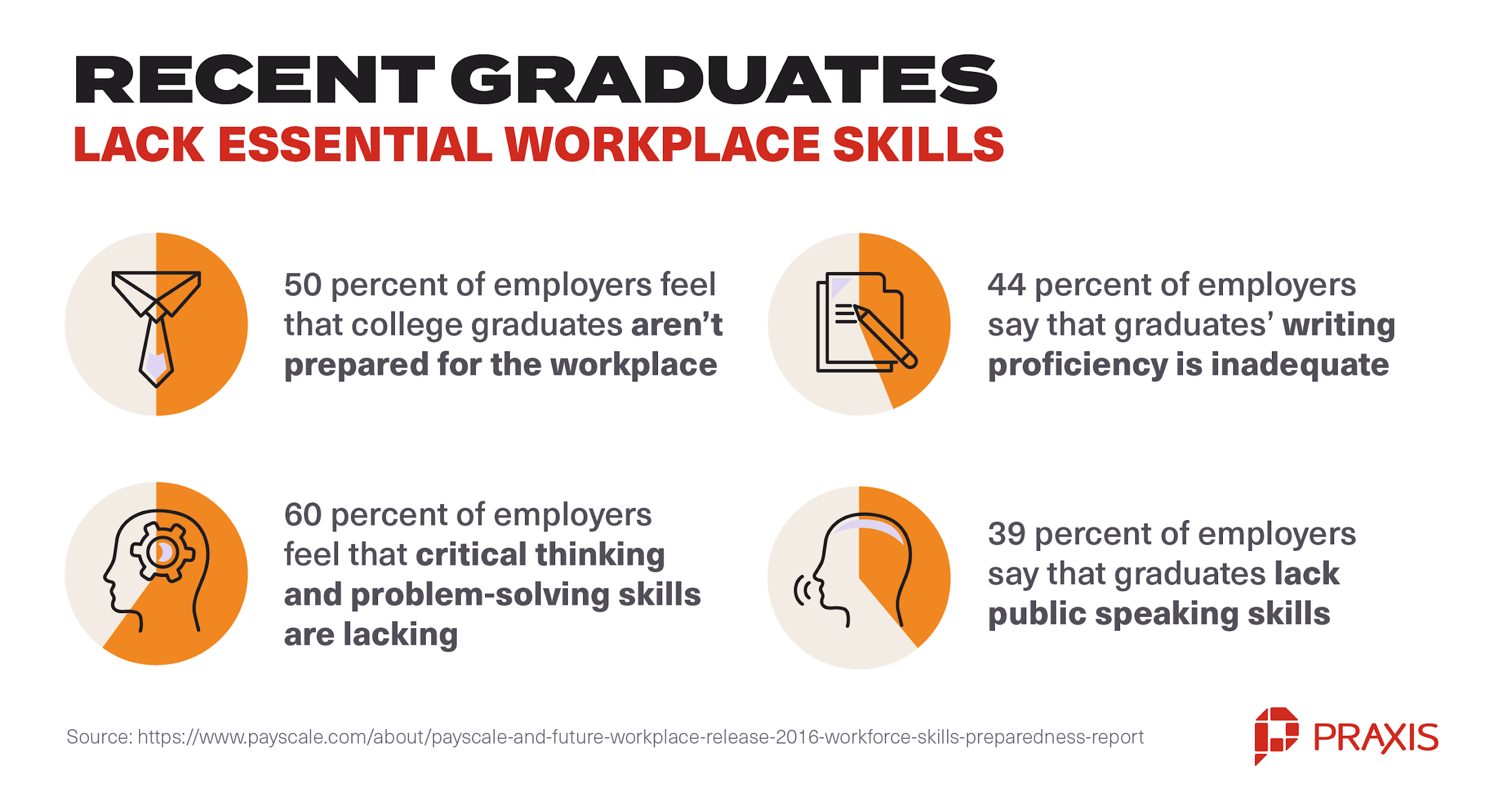

When most job applications look identical, being different sets you apart.

Thanks to degree inflation, a degree carries less weight now than at any other point in American history. What’s degree inflation? Basically, the more people have a degree, the less a degree is worth as a distinguishing signal. Today, 33.4 percent of Americans over the age of 25 have a 4-year degree, and college enrollment numbers continue to rise.

That’s a lot of competition. When every applicant for a job has the same college degree, did the same internships, and joined the same clubs and volunteering programs in college, standing out from the crowd in a big way can only be a good thing.

Before you think that employers won’t consider hiring you without a degree, think again. A recent Learning House survey found that 90 percent of HR leaders are open to hiring applicants who don’t have a four-year degree, and a study by the Harvard Business Review found that 37 percent of employers feel that experience is the most important factor in a job applicant.

In your years, you can teach yourself more about your chosen profession than any college curriculum could teach you. And here’s the important part: because you’re not studying full-time, you’ll have more opportunities to practice the skills you’ve learned in real-world business situations. This means you’ll have far more experience than the average candidate your age and be in a far better position to convince employers that you can create value for them.

Enjoying this content? Drop your email below and we’ll send you our best free resources on succeeding without college:

5. You’ll Gain Genuinely Useful Experience

Four years is a long time to sit in classrooms and miss out on real-world experiences. By choosing not to go to college, and opting to get varied work experience instead, you can gain a distinct advantage over your peers.

A lot of people struggle to gain work experience simply because they think some jobs are beneath them, or because they optimize for income instead of learning and experimentation potential.

The thing is, entry-level positions (especially low-income ones) tend to have a low bar and high turnover, which means it’s very easy for someone who is driven to do an absolutely outstanding job and build a lot of social capital with fairly little effort. Simply show up early, kick ass at your job, and continuously ask for more work.

This social capital could lead to additional responsibility (growth opportunity!), promotions, glowing recommendations, or even getting headhunted if people notice what a stellar job you’re doing.

Whether you start out manning phones, packing shelves, working as a photographer’s assistant, or running your own business, your experiences of working in a business environment and interacting with customers will teach you a lot more about how to work – and excel at it – than four years of college ever could.

6. You’ll Develop Truly Useful Skills

Opting out of college and experimenting with various job opportunities and career paths means you’ll not only gain a lot of experience that will come in handy when persuading prospective employers to hire you – but you’ll also develop truly useful skills.

Let’s say you decide to start a business selling cupcakes. If your cupcake business is to succeed, you’ll need to learn a whole collection of entrepreneurial skills that might include branding, marketing, packaging, design, consumer research, business finance, bookkeeping, and customer service – to name a few.

As your business grows, you may need to outsource some tasks and manage other people, learn about distribution and logistics, negotiate with store managers who stock your products, learn how to use software that helps to streamline your operations, launch an eCommerce site… the list goes on.

These are all skills that will serve you well regardless of whether you work for yourself or want to land a job. And this is just one example. The same is true regardless of whether you decide to become a sales representative, digital marketer, social media influencer, application developer – the sooner you get started, the more useful skills you’ll learn.

7. You’ll Build a Diverse Professional Network

You know that saying “It’s not what you know, it’s who you know”? Well, it’s true, to a large extent.

Did you know that around 85% of positions are filled through networking? Referrals from acquaintances are invaluable when it comes to finding new, better opportunities.

But isn’t college the best way to build your professional network? Sure, college can be a great place to meet people, but the problem is that most of the network you build in college will be people of a similar age and experience level to yourself. This means that it can take as long as ten years for those connections to bear fruit.

As a college opt-out, you’ll have plenty of opportunities to grow your network and build social capital through a variety of internships, projects, jobs, courses, bootcamps, and other activities that expose you to groups of dynamic individuals.

If you’re hungry for opportunities and constantly deliver over and above what’s expected of you, your name will be the first to come to mind when someone needs a referral for someone with your skillset.

8. You’ll Become a Self-Starter and Gain Confidence

One of the major drawbacks of college that a lot of people don’t think about is the fact that it can make you complacent and passive. When you’re always waiting for assignments and seeking external validation in the form of grades, you don’t build a habit of taking initiative and creating value beyond what is asked of you.

The benefit of not going to college is that you’re forced to mature quickly and become a self-starter who takes action. You’ll quickly learn that failing isn’t the end of the world, as long as you learn something from it and get up and try again.

9. You’ll Learn More, Faster, On Your Own

K-12 schooling and college might teach you how to memorize information and take tests, but they don’t really teach you how to learn.

Self-directed learning means taking control of your own education by exploring and researching your learning needs, outlining learning goals, selecting learning strategies that suit your lifestyle and learning style, and evaluating the outcomes of your learning.

In the age of the internet, you can learn just about anything yourself if you embrace self-directed education. There are millions of learning resources available at your fingertips. From YouTube videos to podcasts, to blogs, online courses, to webinars, and much more there are materials available online to help you learn whatever you need to know – not to mention all the offline learning opportunities you could take advantage of, like internships, job shadowing, mentorships, etc.

When you direct your own education, you can learn more, faster (and definitely more cheaply) than you would in college. And because you’re in charge, you only have to learn what’s truly interesting and relevant to you, and you can actively practice what you’re learning, which is much more useful than the rote-learning characteristic of formal education institutions.

If you’re interested in learning more about self-directed learning, read Self-Directed Learning: A Primer for Ambitious Young Adults and 3 Reasons Why You Should Learn Out Loud.

10. You’ll Have Something to Show For All Your Hard Work

When you spend four years in college, it’s all too common to emerge at the end of those four years with nothing to show for it but a piece of paper and a network that still needs years to mature and bear returns.

On the other hand, if you don’t go to college and you apply yourself to creating value by taking on a variety of portfolio projects and work hard to build a digital footprint that documents your personal and professional development, you’ll have built a solid signal of your capabilities and mindset.

Forget the horror stories anyone’s told you about not going to college. You won’t end up making minimum wage for the rest of your life. If you’re driven and willing to work hard, you’ll be just fine.

For more information about choosing your own path after high school, read Don’t Go to College: A Complete Guide to Opting Out & Moving On.

If you’re chomping at the bit to start your career and embrace self-driven education, check out Praxis, the college alternative that leads to a full-time job. Feel free to hit us up in the chat if you have any questions or even you just want someone to discuss your options with.

January 8, 2024