Why do people go to college?

The popular notion in the U.S. today is that if you are a reasonably competent, ambitious young person, you’d do yourself a disservice by not going right into college at 17 or 18.

If you’ve ever aired the idea of opting out of college around relatives, neighbors, teachers, guidance counselors, or even your friends, you may have heard some of these arguments:

- “Going to college will increase your lifetime earnings by $1M!”

- “Sure, there are people who have built successful, lucrative, happy careers without a college degree, but what’re the chances that you’ll be one of them?”

- “You should just get your degree as quickly as possible, the rest of life can wait.”

This is the wrong way to think about your education.

This type of advice tends to focus on probabilities and assurances: the probability of making more money increases with a degree for the average person. The probability of needing a college degree to be successful is higher for the average person. The probability of building a successful career without a degree is low for the average person.

But you’re not “the average person.” You’re a thinking, independent, ambitious individual with a world of educational resources – many of them free – literally at your fingertips. So why go to college?

Even ten years ago, not going to college might have severely hampered your access to educational resources and opportunities, but that’s no longer the case, thanks to the internet.

Forget Probability, Think About the Downsides

It doesn’t make sense to think in terms of probability. Unpredictable factors can always arise and throw off all of your best predictions. And when that day comes, you’ll have to be in the driver’s seat and decide how to proceed.

A better way to think about education is to think in terms of payoffs and downsides.

What does this mean and why is it more useful than thinking in terms of probabilities?

Thinking in terms of payoffs and downsides means that instead of thinking first and foremost about the probable outcomes of a given decision (like going straight to college), we should focus on making the decision that maximizes the payoff while minimizing the downside.

It’s impossible to make a decision with no downside. Time is scarce and every decision naturally comes at the cost of alternative decisions. However, by making sure you consider all the information at your disposal, you can focus on maximizing the upside and minimizing the downside of your decisions.

Instead of putting you in a passive backseat position at the mercy of probabilities (e.g., “I want to be an entrepreneur but I am more likely to make money as a doctor, oh well.”), this mindset empowers you to think of your career and education as things actively within your own control.

Probabilities apply to aggregates, not to individuals, anyway. In any given individual case, there are chances that some unpredictable, entirely random event (“Black Swans”) could make or break you. This is a better way of thinking about decisions because it places you solely in the driver’s seat of your decisions. It allows you to weigh the pros and cons of every decision for you as an individual rather than relying on vague predictions based on aggregates.

Yes, every decision is still a gamble, but if you’re in control, you can hedge your bets by doing everything in your power to increase your odds of winning.

For some people, the downsides of college (the cost, time lost, developing a risk-averse mindset) might be worth the payoff. Perhaps they really need the routine and structure college provides to help them transition into adulthood. For others, college means putting their dreams on hold for four years, and self-directed learning is a more practical and profitable solution.

If you’re factoring probability into your decision-making process, it should be in relation to you as an individual – your abilities and aspirations and limitations.

A lot of people focus on their potential income for specific careers but don’t spend enough time thinking about the probability of feeling fulfilled and satisfied in those careers. So they don’t invest the time to really investigate and test and validate whether this statistically lucrative career path is a good fit for them in the long run. If you don’t really like math, maybe don’t become an accountant.

And while we’re on the topic, college is not an effective way to validate whether a particular career path is a good choice for you, because the college experience doesn’t even vaguely resemble the realities of the job.

Five Reasons the College Payoff Isn’t Worth the Downsides

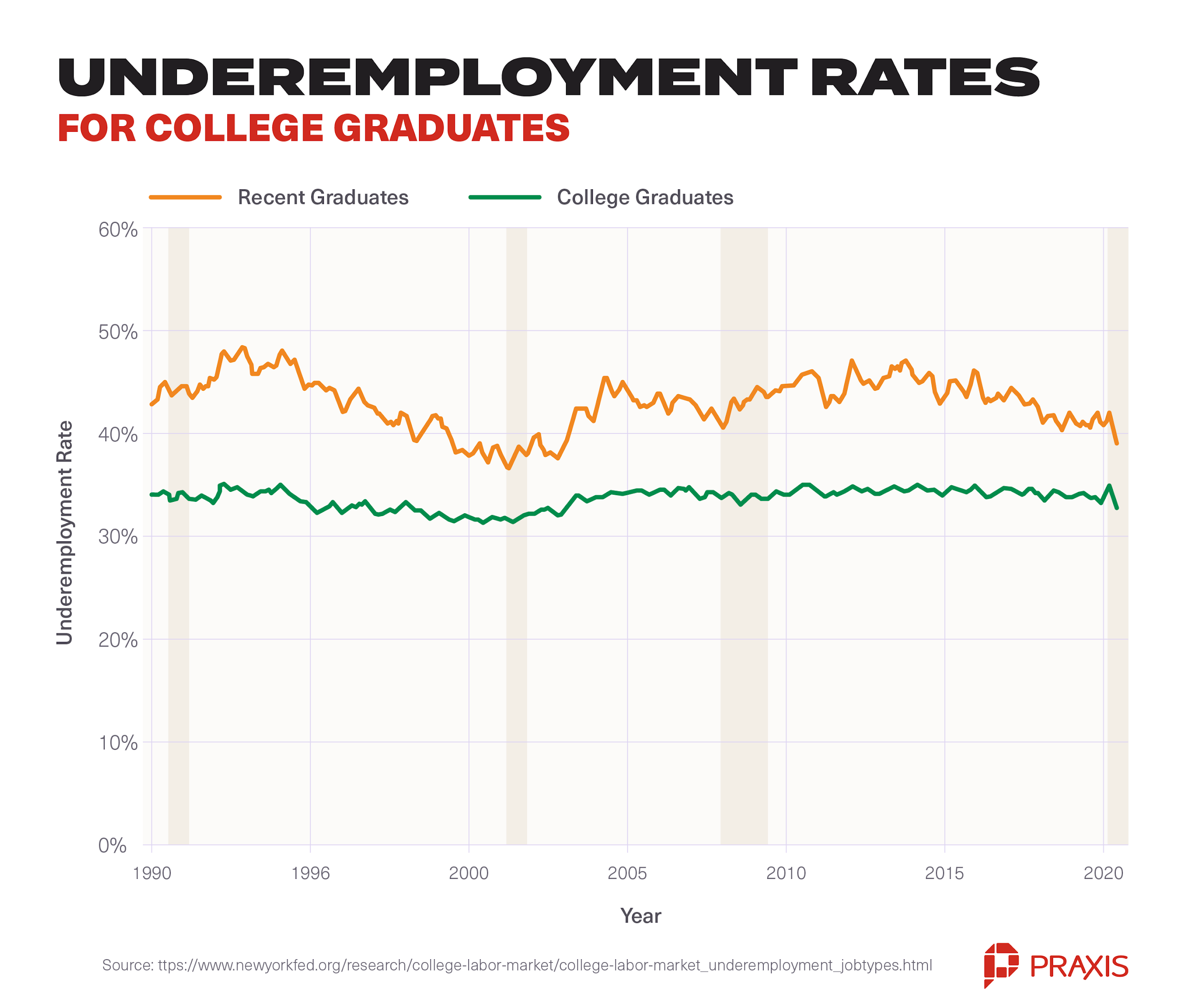

Research by the Federal Reserve Bank of New York reveals that some 39 percent of recent college graduates – and 32.7 percent of all college graduates – are employed in roles that don’t require a degree. In a recent analysis of resumes and job listings performed by Burning Glass estimates that the real number is closer to 43 percent.

That’s a lot of people who likely counted on the probability of college setting them up for a better job and didn’t get the payoff they expected.

Don’t be like those people. Weigh the downsides of college against what you consider the payoff before you make your decision.

Below, we’ll explore five reasons why the payoff of college doesn’t justify the downsides, looking beyond the most obvious downside of the huge financial cost.

Ultimately, the decision is yours to make, but we hope you’ll find this information useful as you weigh the potential payoffs and downsides of all your options.

Reason 1: College Degrees Aren’t Worth As Much As They Used to Be

Going to college has never been a guarantee of later success, but in the past, when having a degree was relatively rare, it served as a signal that marked you as somewhat exceptional. Today, this is no longer the case, thanks to degree inflation.

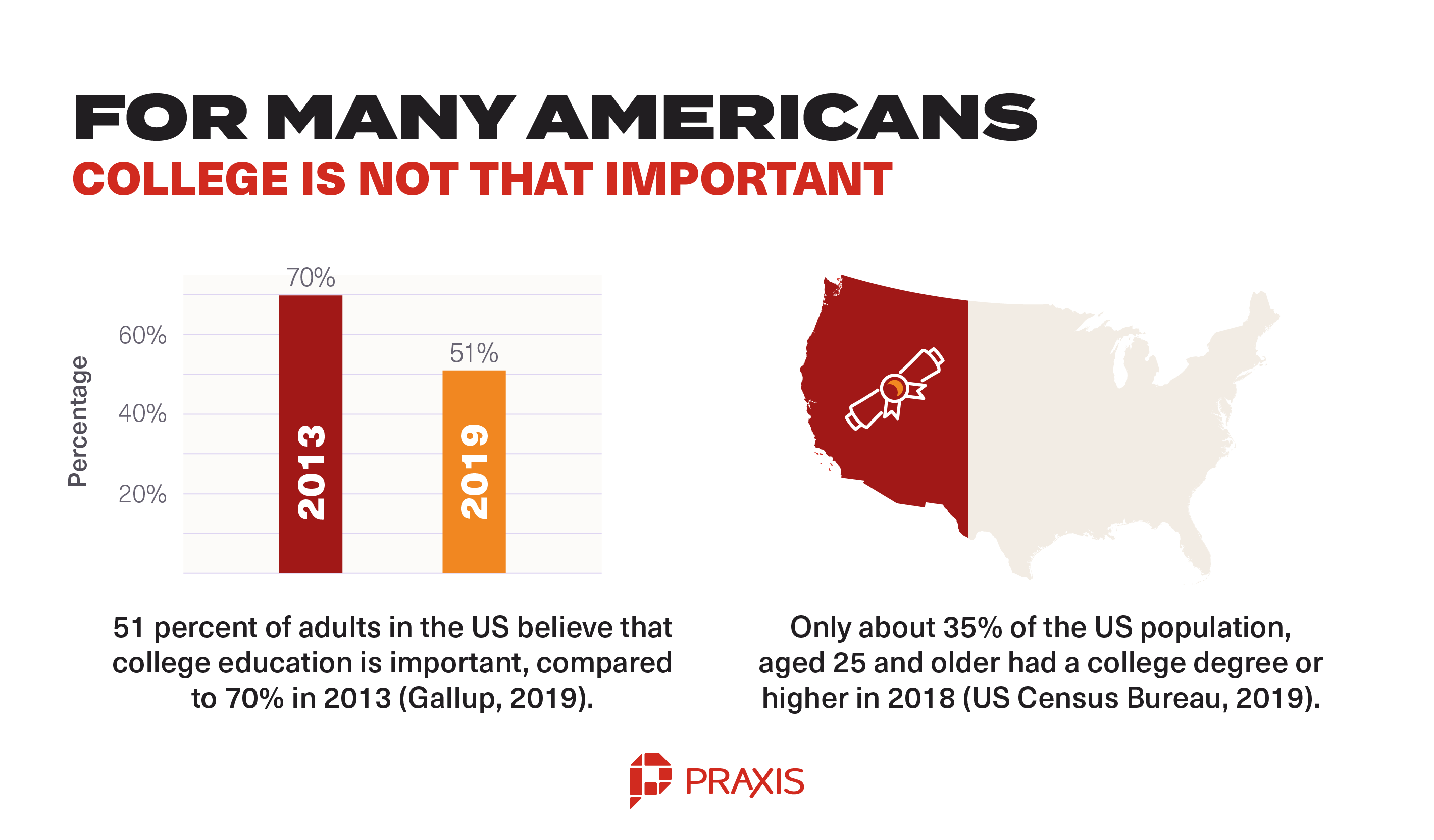

With 35 percent of U.S. adults over the age of 25 holding a college degree, a bachelor’s degree simply isn’t worth much as a signal anymore, unless you went to a top-tier school and you were at the top of your class. Jobs that never used to require degrees (and still don’t really) are now listing them as application requirements, just because they can. Meanwhile, jobs that used to require a Bachelor’s now ask for a Master’s, and so on.

The truth is, none of this actually matters, because college doesn’t really prepare you for the real world. According to research by Pearson, 87 percent of companies say graduates lack the skills needed to do their job and require significant training before they can perform their role effectively.

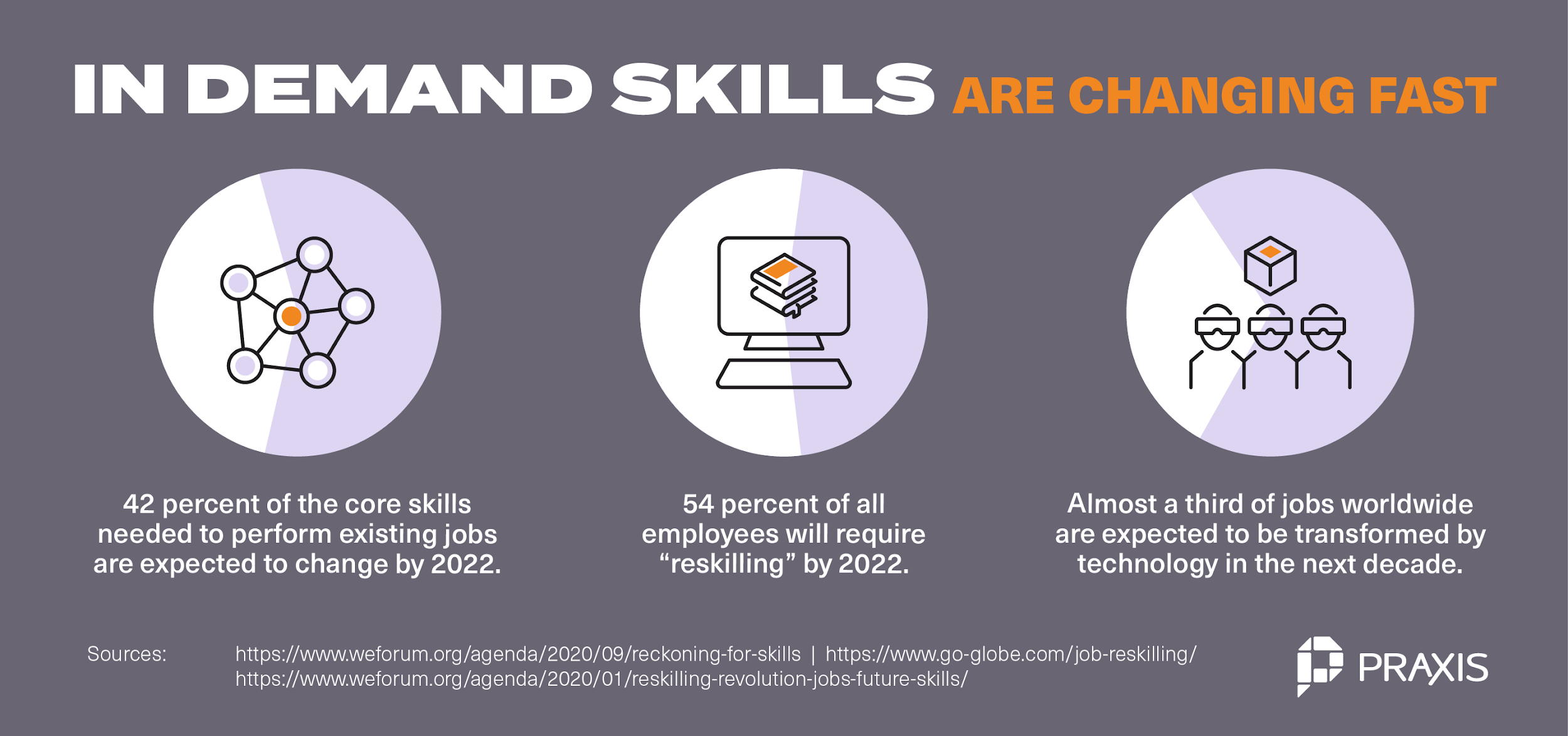

The world of work is changing rapidly. According to the World Economic Forum, skills – not degrees – will shape the future of work.

Smart companies are throwing degree requirements out the window. The skills companies hire for are changing faster than college curricula can keep pace with. That means that having the skills they need is much more likely to get you hired than a degree without the skills.

Hell, a lot of the jobs of the future don’t even exist yet, which means no college curriculum in the world could prepare you for them, but an adaptive attitude and a passion for constant learning can.

In the past, college degrees served as a kind of “stamp of approval” that made it easier for employers to take a risk on hiring someone they didn’t know much about.

But now, with all the possibilities created by the internet, you can give prospective employers actual evidence of your ability to create value for them by creating a digital footprint that showcases your skills, work ethic, and thirst for learning – which is much more valuable to a hiring manager than a degree.

Reason 2: Perceptions of College Are Changing

For a long time, getting a college education has been seen as a ticket to upward mobility.

In some social circles, going to college after graduating high school is the expected norm – so much so that if someone asks you “which college are you going to” and you say “I’m actually not going to college,” you’re likely to get raised eyebrows and concerned frowns.

The idea that you need to go to college to amount to anything is a deeply entrenched stereotype, but times are changing.

It turns out, only 51 percent of American adults believe that a college education is important, compared to 71% in 2013. That’s a big change in perceptions in a fairly short time. Maybe part of the reason for this change is the fact that while just over a third of U.S. adults over the age of 25 hold a degree, the median annual household income in the U.S. was $63,179 in 2018, which means that quite a lot of people who don’t hold degrees are doing just fine without them.

With so many stories of college optouts and dropouts becoming wildly successful entrepreneurs becoming part of our shared narrative, there’s a renewed admiration for the “self-made” entrepreneur.

The self-made entrepreneur lies at the heart of the American Dream – they’re the fiercely independent figures who pull themselves up by their bootstraps, takes names, and get sh*t done. What could be more American than applying the self-made approach to your own education and making a success of yourself?

Reason 3: College Carries a Huge Opportunity Cost

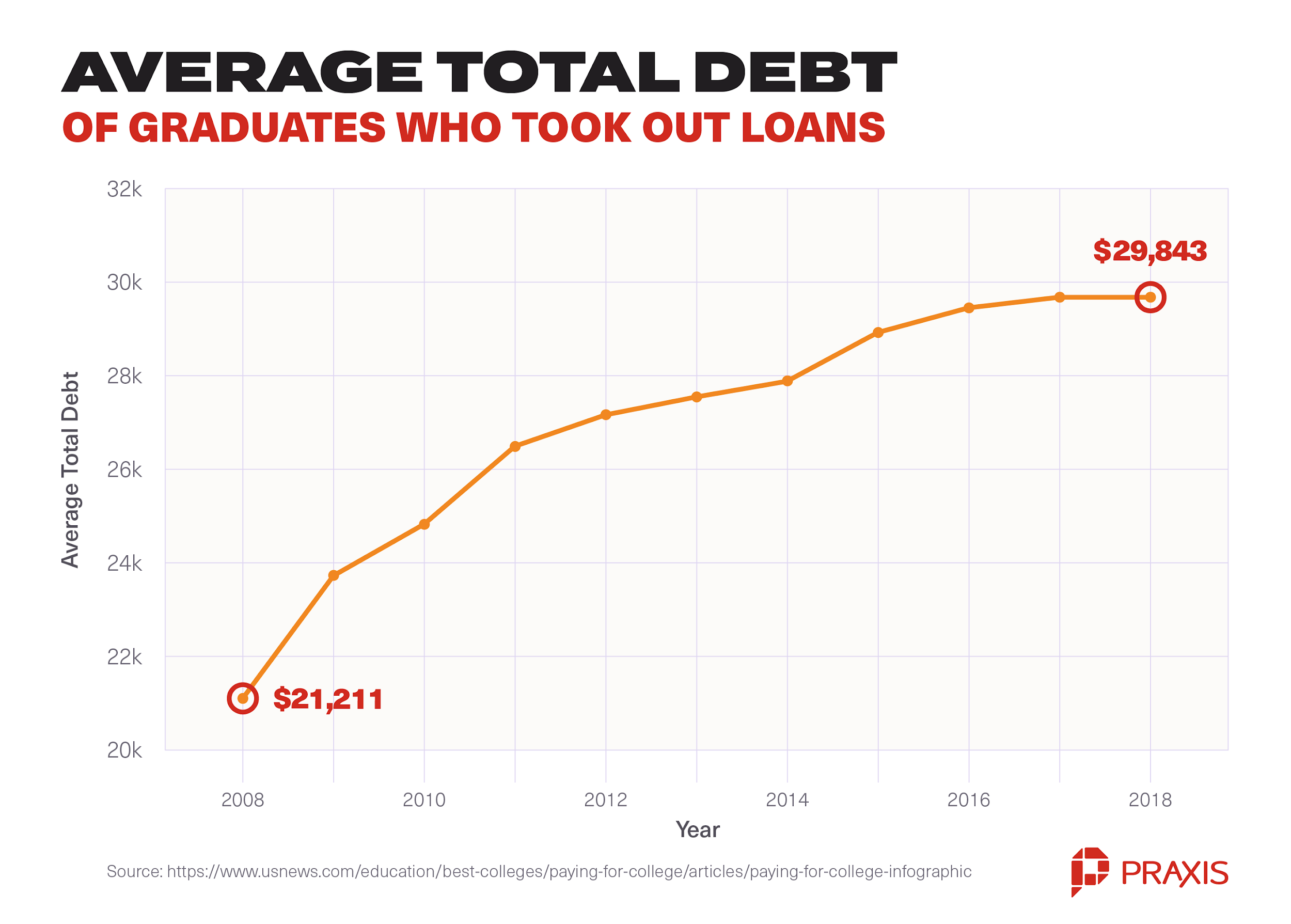

People often talk about college in terms of the financial cost – which is unsurprising, because it’s a lot. In 2018, the average student loan borrower in the U.S. owed $29,843 in total. For many, that number is much higher.

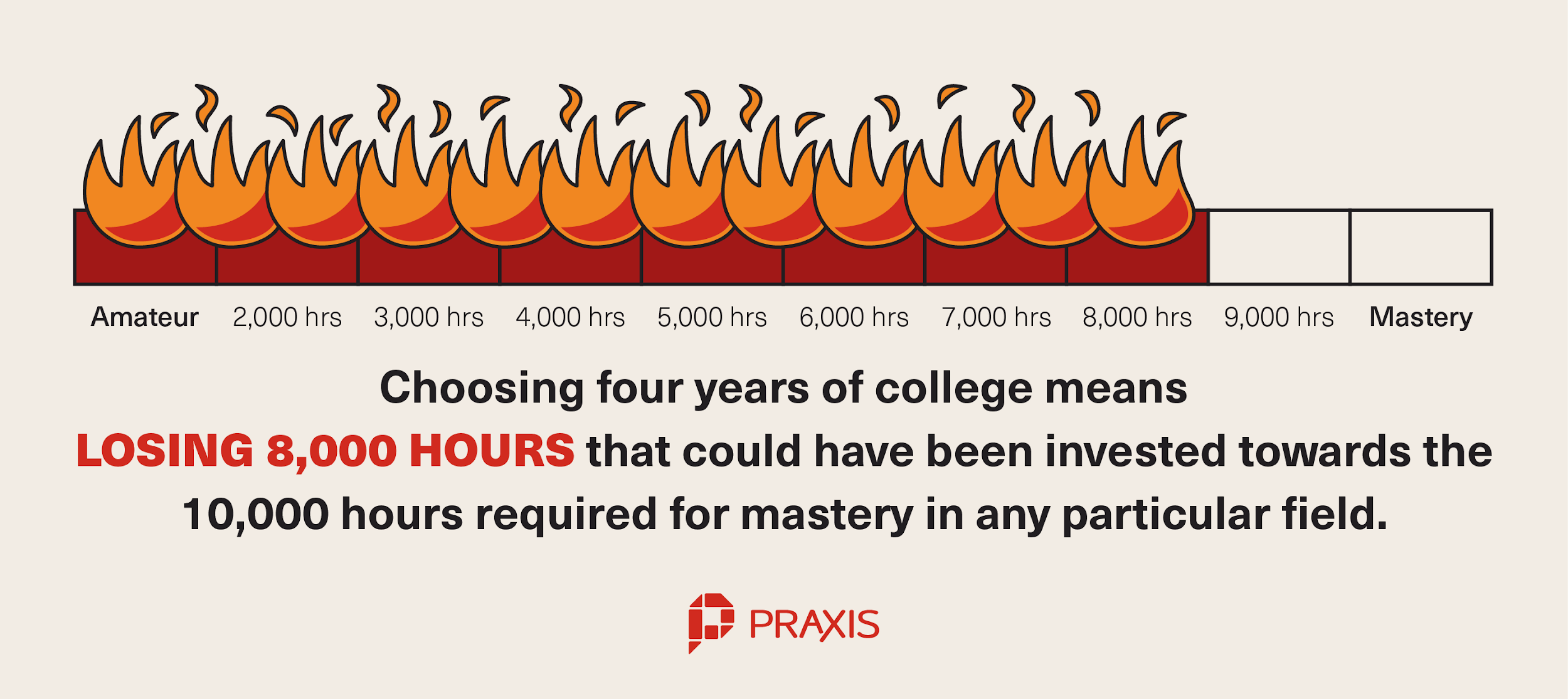

What people often neglect to consider is the opportunity cost of attending college. Four years spent in classrooms listening to lectures and taking tests is poor preparation for the real world. More than that: it actually sets you back four years in terms of real, hands-on, practical experience of how the business world works and learning skills you could use to create value for employers or customers.

Aside from the obvious opportunity cost of spending 8,000 hours of your life in college, there’s a deeper, more insidious opportunity cost: college can make you timid and risk-averse. College gets you in the habit of waiting for someone to give you direction, give you assignments, give you praise for doing your work.

This attitude can significantly hamper your professional and personal development because instead of being a proactive go-getter who comes up with and executes great ideas, you default to responsive-mode and hoping someone will notice the good work you’re doing and reward you for it.

Reason 4: There’s a Real Chance You’ll Drop Out

Even if you’re absolutely sure college is the right choice for you and you think the downside is worth the payoff, there’s a very real chance you’ll drop out.

- Maybe you’ll realize that you’re not so keen on the career you had in mind after all.

- Maybe you’ll run into financial issues and decide college isn’t worth the cost of tuition.

- Maybe you’ll struggle to balance holding down a job with fulfilling your degree requirements. Maybe you’ll realize that the college experience doesn’t remotely resemble the day-to-day reality and challenges of the business world and isn’t adequately preparing you for what’s to come.

- Maybe you’ll simply realize that sitting in lectures and taking tests is not the best use of your time.

And that’s okay.

Counter to what your aunts and uncles might think, dropping out of college is not the worst thing that can happen to you. In our view, realizing that college isn’t the right fit for you and dropping out is a better choice than spending four precious years – not to mention quite a lot of money – in pursuit of a degree that’s far less valuable than a useful skillset and a can-do attitude.

College dropout rates are high:

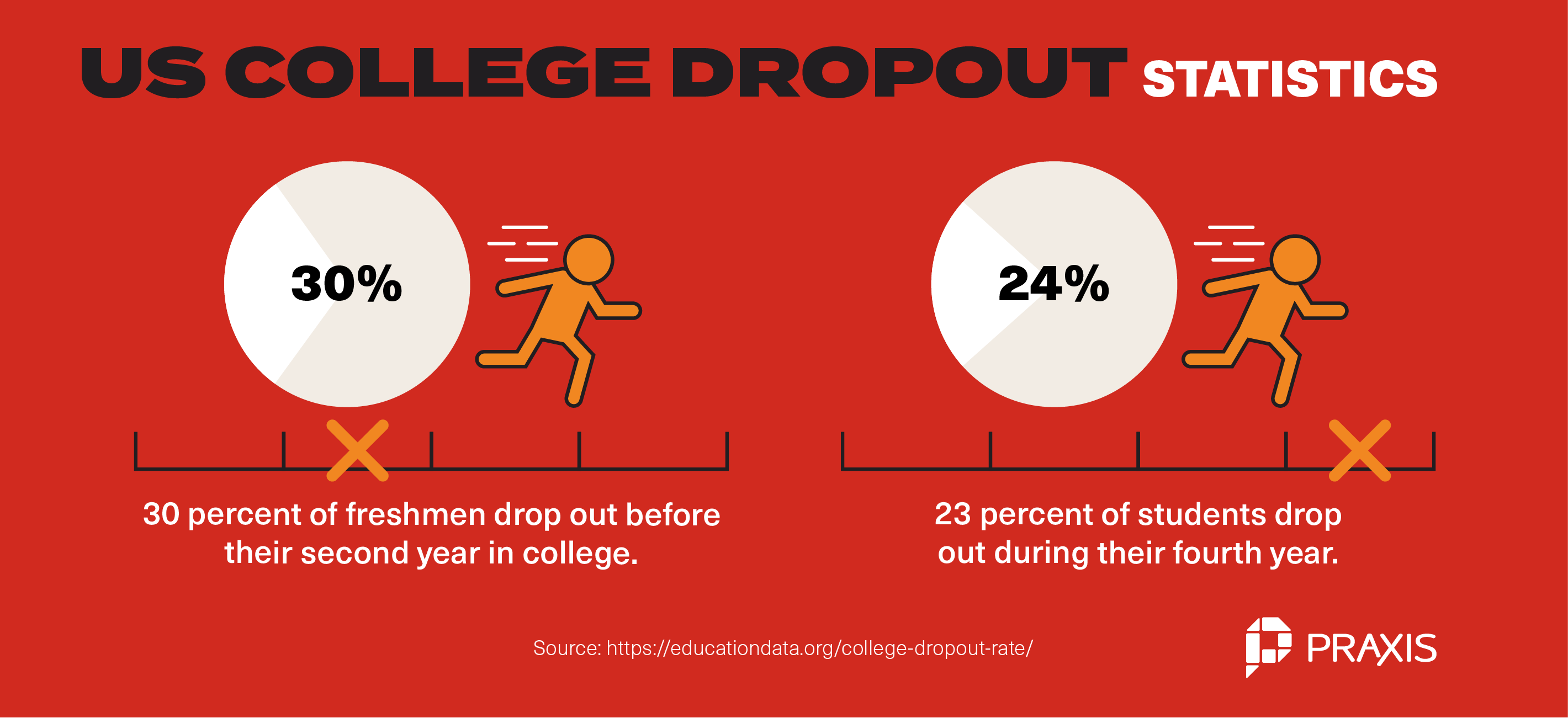

- 30 percent of freshmen drop out of college before their second year.

- 23 percent of college students drop out during their fourth year.

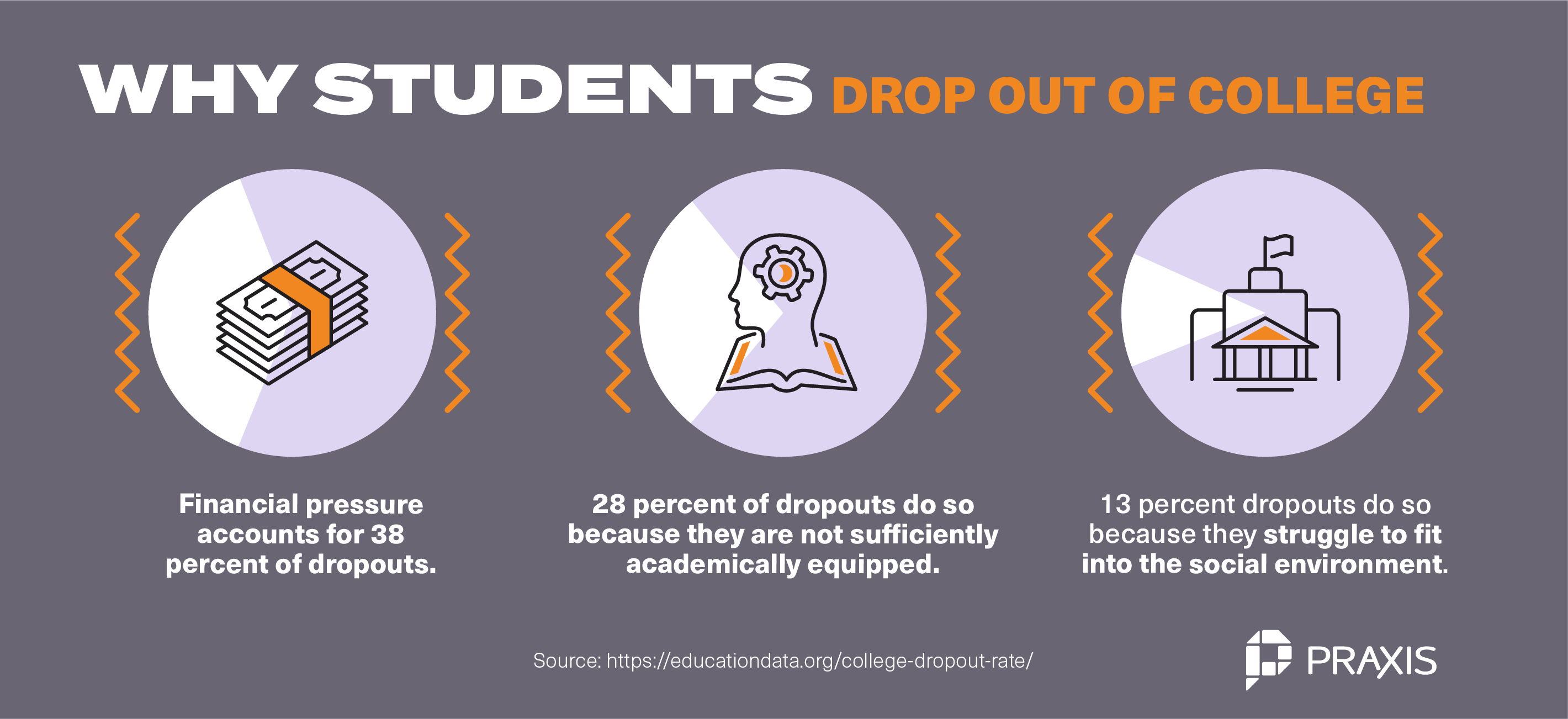

- 38 percent of dropouts cite financial pressure as the reasons they dropped out, 28 percent because they found they weren’t equipped to deal with the academic requirements of the course, and 13 percent because they struggled to fit into the social environment.

- 40 percent of students who drop out are first-generation college students whose parents did not attend college.

If you’re in college and considering dropping out, read our recent post Dropping Out of College: A Guide to Landing on Your Feet.

Reason 5: You Won’t Necessarily Make More Money If You Go to College

As we established earlier, there’s a widespread conception that going to college increases the probability of earning more. Now, setting aside the question of student loans – the total student loan debt in the U.S. is $1.6 trillion and the standard repayment period of student loans is between 10 to 30 years – the reality is that going to college doesn’t equal a higher income in itself.

The truth is that there is huge variability in outcome at every level of education. Two people with exactly the same level of educational attainment can get hired at the same company and be earning dramatically different salaries a year or two later.

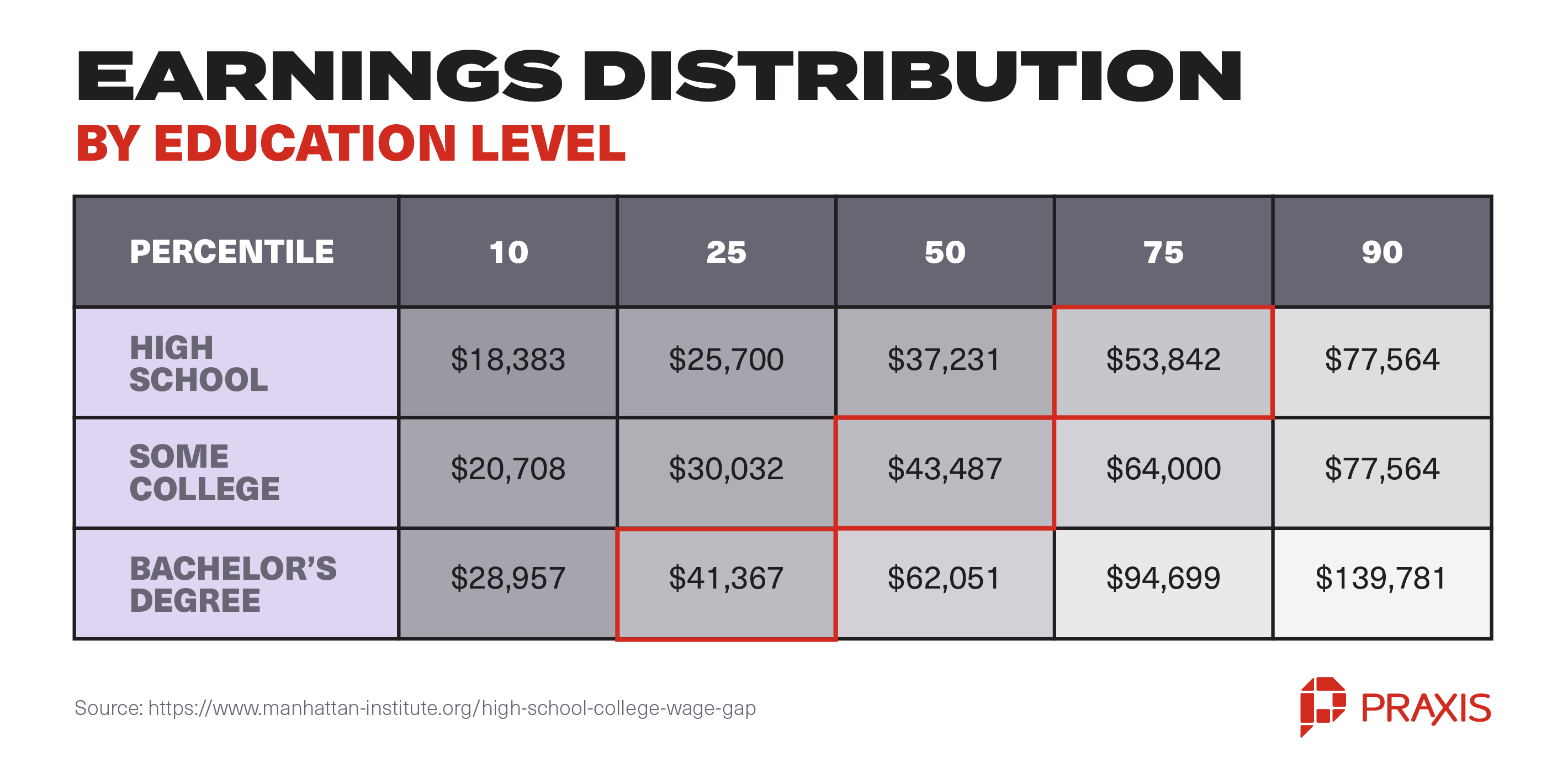

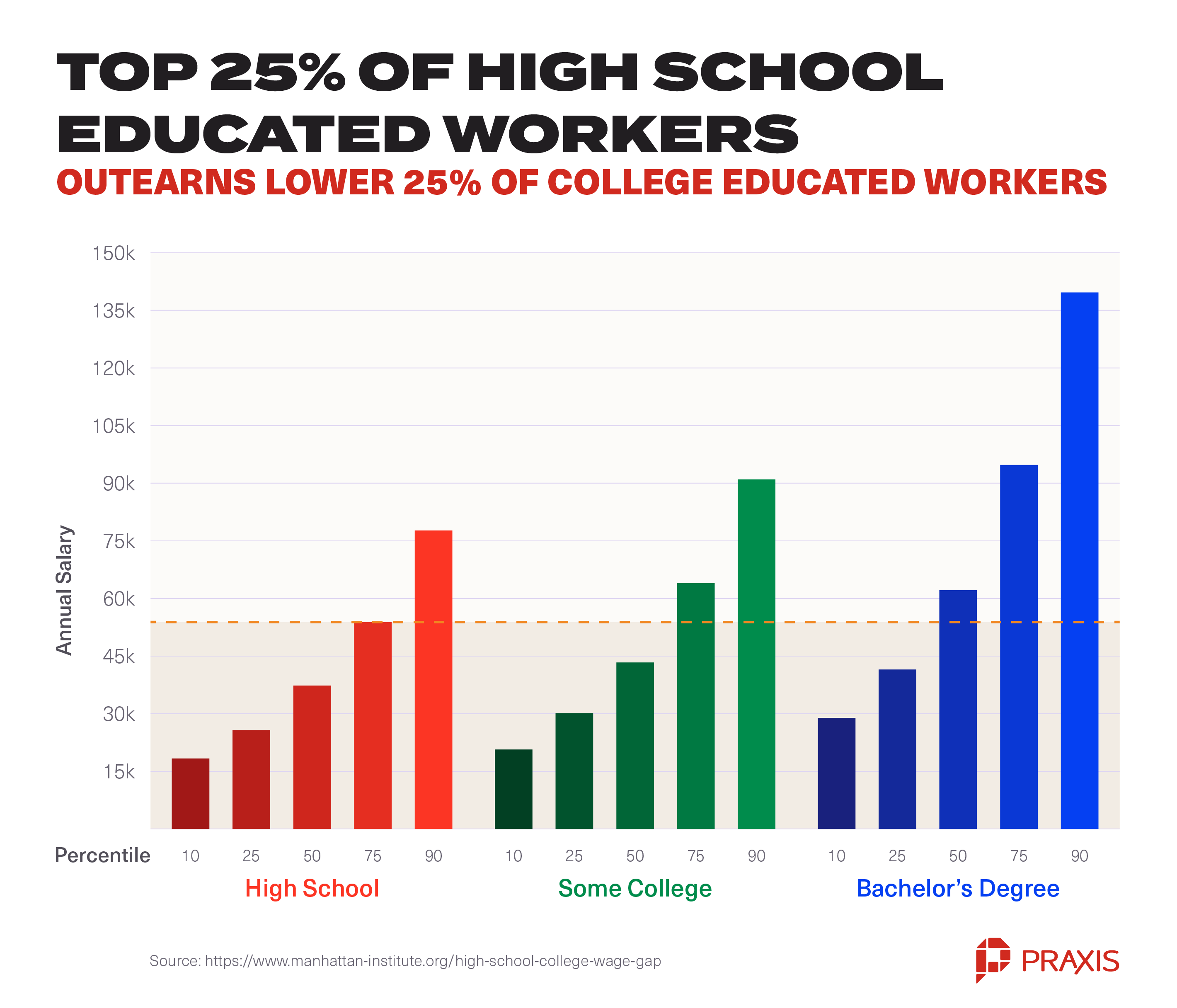

What’s interesting is that quite often, people without a college education end up outearning college graduates. Data from the U.S. Bureau of Labor Statistics reveals that the top 25 percent of high school graduates outperform the bottom 25% of college graduates.

To dig a little deeper, the 50th-90th percentile range for high school graduates performs better than the 10th-50th percentiles for holders of a Bachelor’s degree. Simply put, the top half of high school graduates outearn the bottom half of Bachelor’s degree holders. The 75th percentile of high school graduates outearns the 25th percentile of BA earners as well as the 50th percentile of earners with some college. This means that every individual in the top 25 percent of high school graduates outperforms every individual in the bottom 25 percent of BA holders and most individuals with some college.

In a nutshell: college degrees are not determiners of wealth. Individuals are.

How successful you are in life comes down to your attitude, work ethic, and access to opportunities. With all the resources available online today, having access to the internet means you have access to opportunities – the rest is up to you.

So the next time your nay-saying relatives or peers or guidance counselor – or whoever – wants to talk to you about probable income relative to college education, show them this post and tell them you’d rather bet on yourself than measure yourself against national averages.

If you’re still on the fence about whether or not college is the right choice for you, check out Should I Go to College? our checklist of questions to ask yourself to help you make the best decision for you.

A College Alternative with a High Payoff and Few Downsides

If you’re starting to think that the payoff of college isn’t high enough to justify the downsides, you should consider Praxis, a college alternative that maximizes your returns while minimizing the downsides.

Our program is designed to put you in the driver’s seat of your education and career and get you from point A (graduating high school) to Z (getting a full-time job) in as little time and at as low a cost as is feasible.

At Praxis, participants learn about how the business world works and explore how their own interests and skills line up with various career paths while building up the professional skills they’ll need to succeed in the workplace. If you can devote 10-15 hours per week to this part of the program, this will set you up for success. Plus, you can spend the rest of your time working on your own projects, learning, or holding down a job. Low downside, anyone?

By the time you complete the six-month remote bootcamp portion of our program, you’ll have hands-on experience, practical skills, a network of inspired new peers, and a portfolio of projects that showcase your ability to create value. Even more importantly, you’ll have unshakeable confidence in yourself and your abilities.

These will come in handy at your new full-time job. We’ll help you decide which job opportunity is the best fit for you and offer you continued support and mentoring for your first six months on-the-job.

Praxis tuition costs $12K per year, and here the payoff-downside equation is extra relevant. To show how certain we are that Praxis delivers real value, we also put some skin in the game with you: We believe that our success should be tied to yours, so if you’re not hired full-time within six months of completing the bootcamp, you won’t pay a thing.

That’s a pretty good downside-to-payoff ratio.

October 22, 2020