You’re standing at a crossroads, asking yourself what your future looks like and which route will get you there the fastest. Odds are, you’ve considered college. After all, it’s what everyone says you should do if you want to make a decent living.

If you’re reading this post, it means you’re asking yourself whether college is really worth it.

Congratulations, you’re on the right track! Questioning is good. Information is power.

Even if you end up choosing to go to college after you’ve read everything we have to share on the topic, you’ll go forward making an informed decision instead of simply going to college as a default.

College is a big investment not just in terms of money, but time as well. While going to college may seem like a no-brainer for many people, it’s a major decision not to be taken lightly.

Keep reading and then decide whether college is worth it for you.

Is College Worth the Cost?

In a recent poll by the University of California, some 85 percent of freshmen cited “the ability to get a better job” as a “very important” reason for attending college, and 72 percent cited “the ability to make more money.”

But the truth is, having a degree doesn’t always result in a better job or more money. College offers no certainty or guarantees.

What is certain is that college is astronomically expensive, and many prospective students wildly underestimate the real costs.

A recent survey found that on average, near-graduates estimate that it will take six years to pay off their student loan debt, while data shows that 20 years is a more realistic estimation. The same study found that 93 percent of near-graduates believe they’ll get a job related to their studies within 6 months of graduating; but, only around 60 percent do.

6 Things You Should Know About the Cost of College

You’ve heard it before. “College is expensive!” But how expensive, exactly? And isn’t everything just more expensive now than it used to be?

1. What Does College Really Cost?

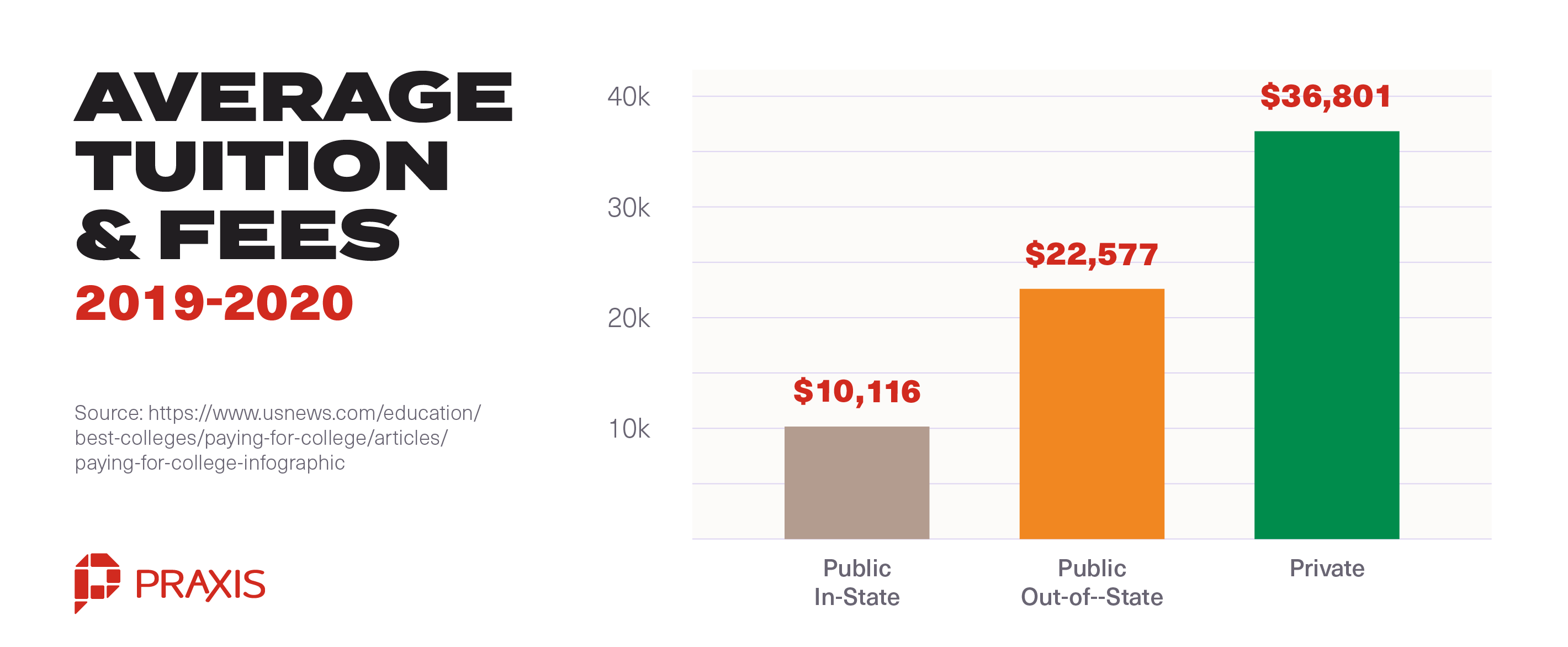

The national average cost to attend a four-year institution is $26,120 per year, bringing the current total cost of attendance to an average of $104,480 over four years. And that’s not including interest.

And that’s just the national average. The average private college tuition clocks in at $36,801 per year, with at least 120 ranked private colleges charging more than $50,000 per year.

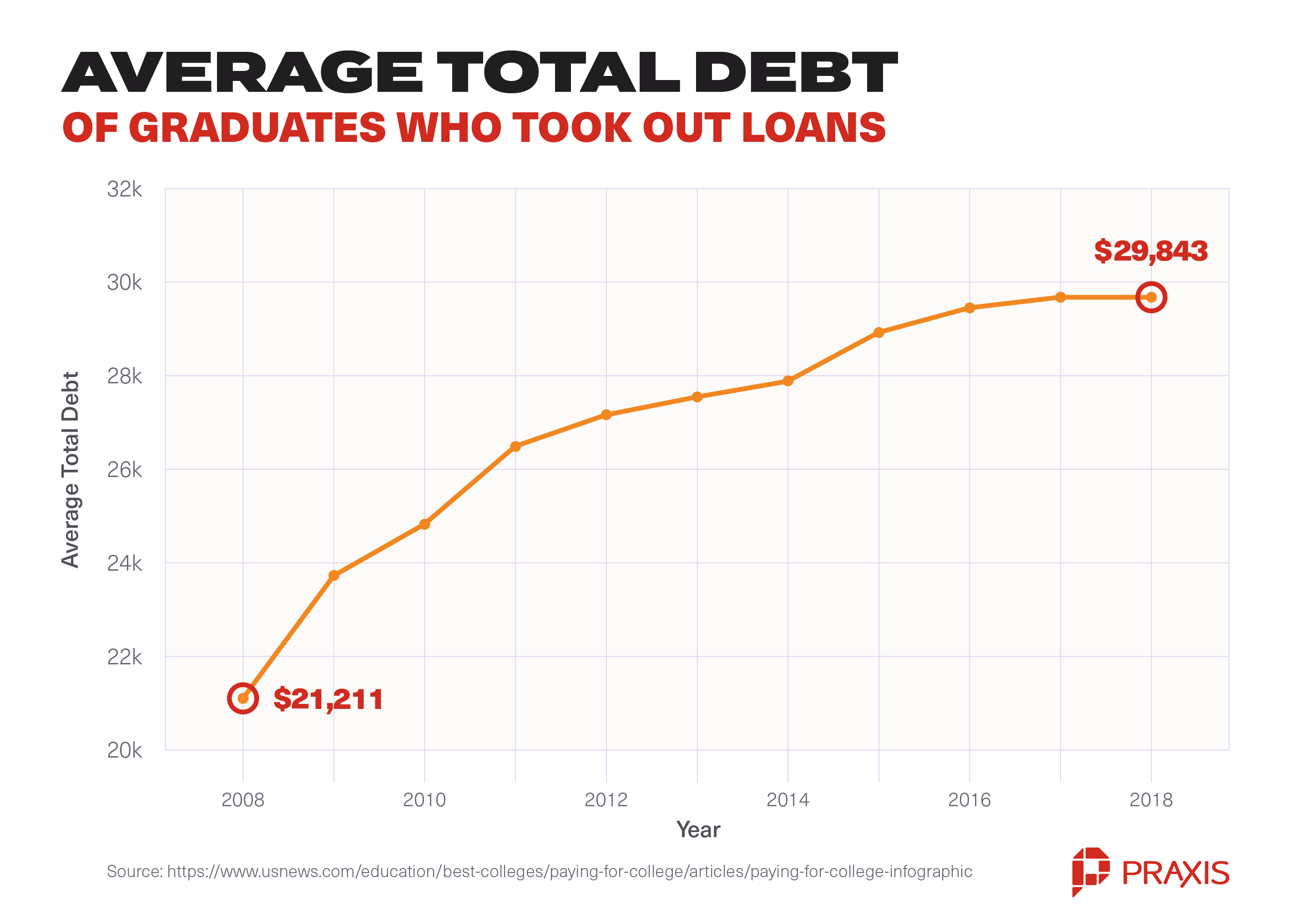

2. College Debt Is Reaching Crisis Levels

More than 45 million Americans owe a collective of $1.6 trillion. Almost five million Americans have defaulted on their student loans, and the average debt is now at the highest it’s ever been, at $29,800 per student.

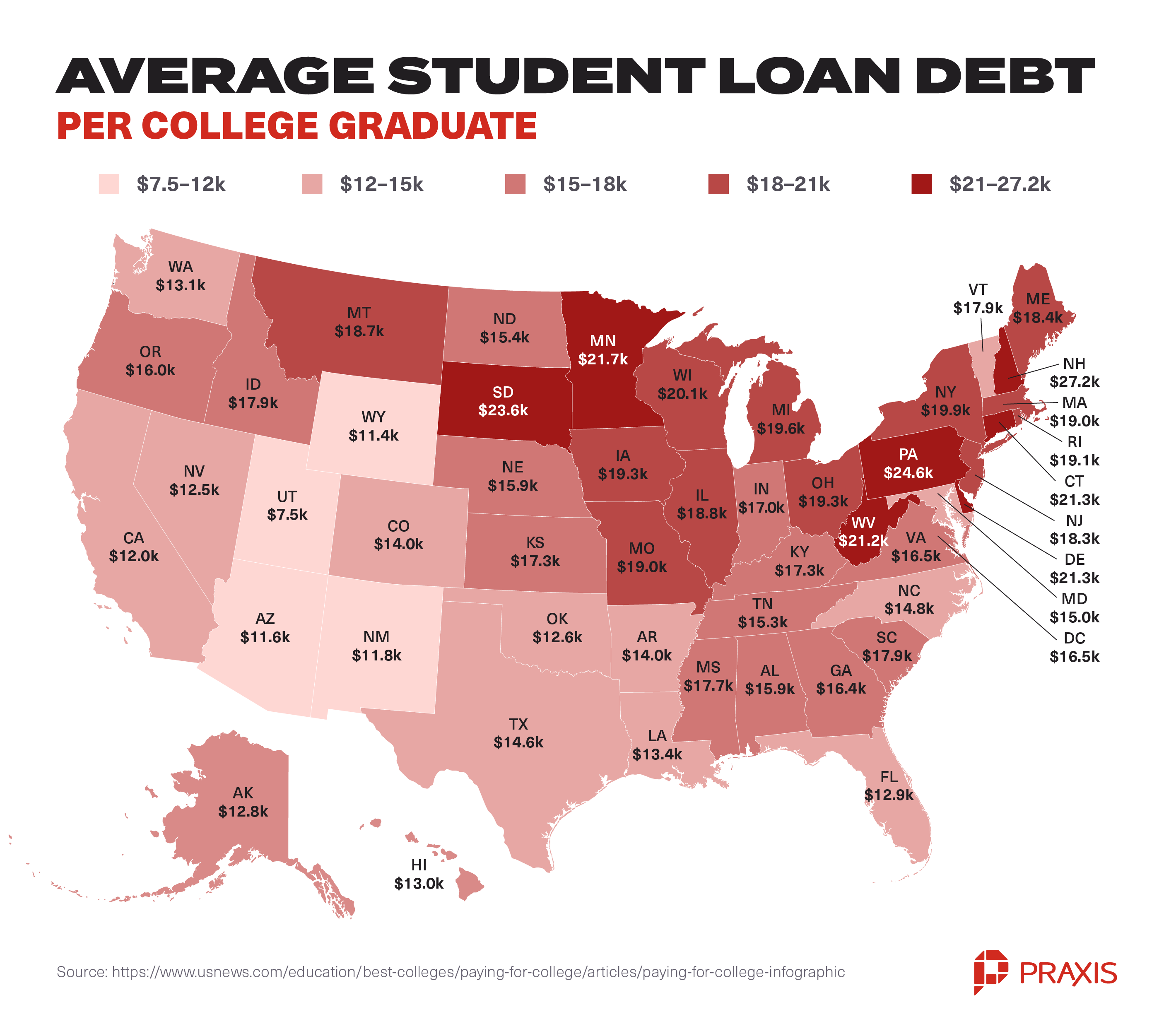

3. Tuition Fees – and Student Debts – Vary By State

Where you go to college can have a significant impact on your tuition fees and long-term student debt.

The map below shows how student loan debt averages vary from state to state:

4. College Is Getting More Expensive Relative to Income

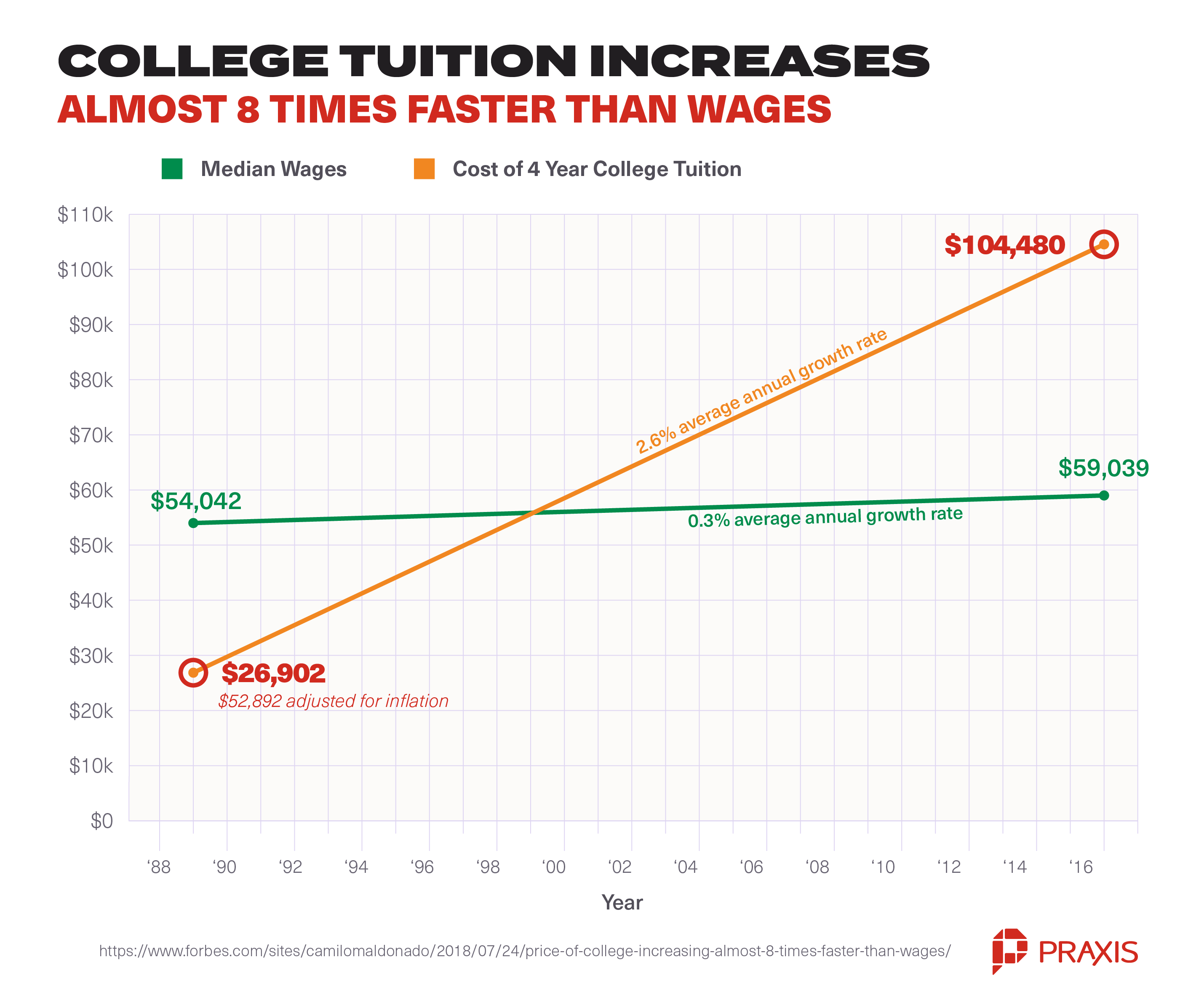

Between 1989 and 2016, the cost of attending university grew eight times as much as the average wage increase.

In 1989, the average cost for four-year college education came to $26,120 ($52,892 adjusted for inflation). In 2016, that same four-year education averaged at $104,480. That’s an annual growth rate of 2.6%, which doesn’t seem so bad until you compare it to the rate at which the median wage has grown in the same period.

Between 1989 and 2016, the median wage grew from $54,042 to $59,039. That’s a 0.3% increase (roughly an eighth of the rate at which tuition increased). If this all sounds complicated, check out the chart below.

Enjoying this content? Drop your email below and we’ll send you our best free resources on succeeding without college:

5. Tuition Is Heavily Subsidized by International Students

While U.S. students may not realize it, the cost of their tuition is often heavily subsidized by the fees paid by international students to make up for cuts in state funding.

According to a recent study by the American Council on Education, many colleges charge international students between $874 and $5,218 more in tuition and other fees than out-of-state students. According to the College Board, the average published cost of tuition and fees and room and board at a public four-year institution in 2018-19 was $21,270 for in-state students and $37,430 for out-of-state students.

In the aftermath of COVID-19, the American Council on Education predicts that international student registrations will fall by as much as 25 percent from the current enrollment of approximately 870,000 international students. It is expected that this will raise the cost of tuition at institutions that charge international students out-of-state fees.

6. Colleges Make Money By Giving It Away

Not many people know this, but colleges make more money by making their fees so high that they need to “subsidize” tuition by giving students “discounts.” To spell it out: colleges only qualify for charity status (501(c)(3)) if more than half of their students are on financial aid. Why would they want charity status? The short answer: to keep the massive returns of their endowment investments tax-free. It really makes you wonder if American colleges are deliberately making their tuitions unaffordable.

7 Reasons Why College Is Not Worth It

Deciding whether or not to go to college is not a decision between a well-paying career and being unemployed or working a minimum-wage job in retail or food-service for the rest of your life.

These are not the only options.

You don’t have to resign yourself to going with the flow and getting a degree just because it’s expected of you – or working deadbeat jobs because you think it’s your only option.

It’s entirely possible to skip college, save yourself from a mountain of student debt, and invest those four years in your own development.

You can take control of your life and your career, develop the skills you need to succeed, and build a fulfilling and meaningful career doing something you really love.

1. Underemployment Is Common Among College Graduates

According to estimates by the Federal Reserve bank of New York, around 43 percent of college graduates are working jobs that don’t require a degree. Meanwhile, the employment rate for 25-35-year-olds without a college education is at a high 72 percent.

Some 22 million American workers are underemployed – that’s to say, they’re overqualified for the work they’re doing, or they’re working part-time when they’d prefer a full-time job.

Ending up underemployed and struggling to make your student loan payments (while your debt actually grows) is the opposite of a good investment.

2. College Carries a Huge Time and Opportunity Cost

It’s worth considering that the cost of college is more than just what you pay for tuition, housing, books, and interest on your debt – you’re also paying a significant opportunity cost. In addition to likely creating a mountain of debt that will take you years to settle and might get in the way of important life decisions by making you risk-averse, you’re losing out on at least four years’ potential wages.

But there’s more.

In his book Outliers, Malcolm Gladwell popularized research by Anders Ericsson, a Swedish performance researcher who studied the history of elite performers across many disciplines.

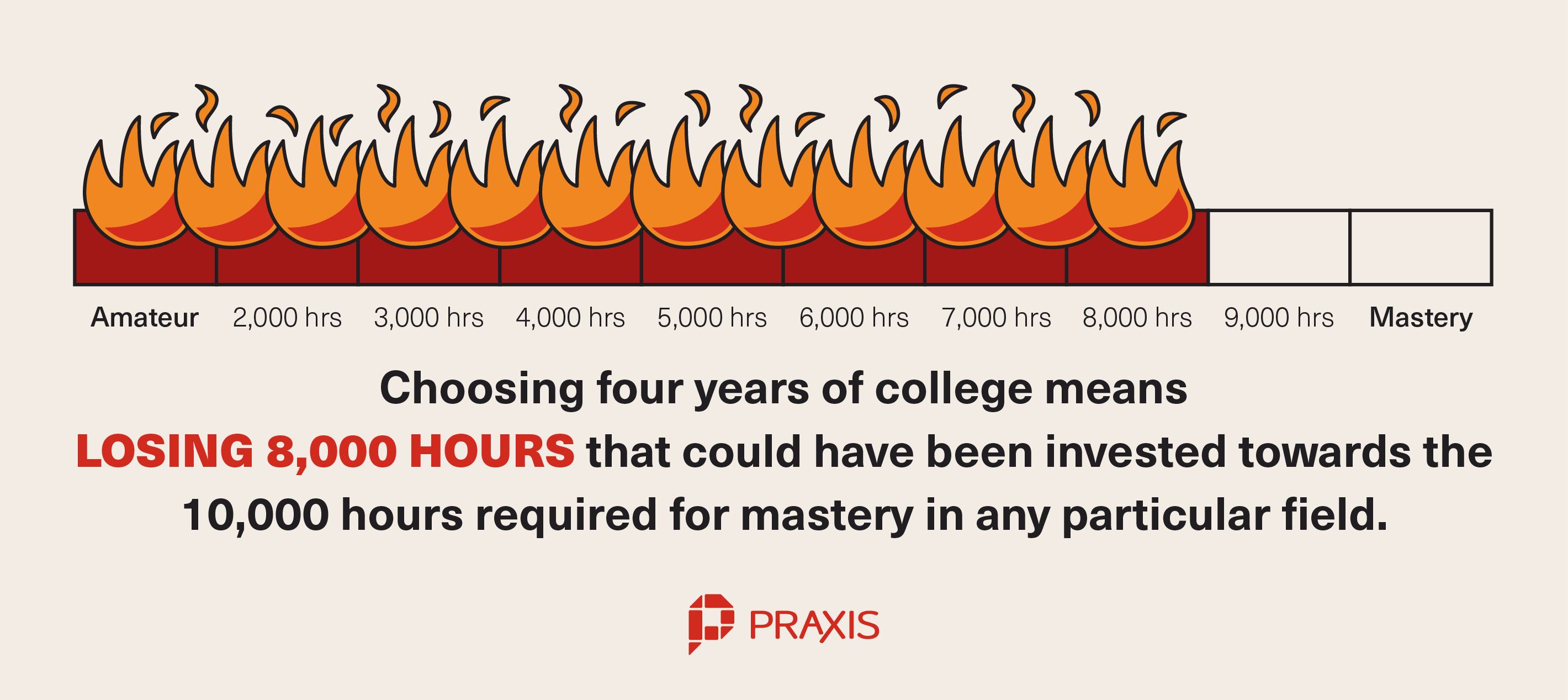

He found that many elite performers broke through around the point they reached 10,000 hours of dedicated practice. 10,000 hours is a lot of time. But so is college.

Four or five years spent in a Bachelor of Arts degree takes away time you could have dedicated to approaching mastery at a skill. If you work nine to five, five days a week, fifty weeks a year, you hit 2,000 hours per year.

In other words, choosing a four-year degree is a decision about how to spend around 8,000 hours. Attaining mastery in any discipline is more about practice than credentials. And being a master or specialist in your field means you can charge more for your time.

If you simply decided to pursue a skill on your own, to work at it like a job for the four years of a college degree, you would be nearing 10,000 hours by the time your peers are wrapping up classes. While they are receiving their degrees, you could be at a professional level in programming, writing, language learning, or almost any skill of your choice.

Four years in lecture halls means four years not spent on the road to mastery.

The price of college is too high, even if you manage to avoid the financial cost. 8,000 hours is a massive investment, so spend it wisely!

3. Debtors Get Trapped in Jobs They Hate

According to a recent report by Strada Institute for the Future of Work and Burning Glass Technologies, more than 40 percent of college graduates take jobs that don’t require a college degree straight out of college. Some three-quarters of these graduates are still in the same job ten years later.

In a recent survey, 61 percent of surveyed college students said they’d take a job they’re not passionate about to pay off their student loans. The pressure to pay towards student loans each month can really limit your career growth by making you afraid to leave a job where you’re underemployed or unhappy because you need income security.

Wouldn’t it be better to just skip all that and start building a career you love straightaway?

4. College (Debt) Delays Important Investment Milestones

College not only postpones the start of your career by four years, but the debt incurred also leads to graduates delaying a number of key milestones including homeownership, marriage, and having children.

A recent study by the Federal Reserve found that around 20 percent of the decline in homeownership rates among millennials can be directly attributed to student debt – representing some 400,000 graduates. According to the National Association of Realtors, student debt delays homeownership among millennials by an average of seven years.

A recent study by LendKey Technologies found that one-third of respondents under the age of 34 would postpone marriage until their student debts are paid off. Similarly, one in three surveyed student loan borrowers have delayed having children due to their debt.

5. You Don’t Need College to Get a Great Job

As we’ve covered in our recent blog Don’t Go to College, plenty of leading companies no longer view college qualifications as a prerequisite for hiring, and a pretty significant portion of the world’s top entrepreneurs and billionaires dropped out of college.

Not only are a growing number of companies dropping college degrees as a requirement for applicants, but degree requirements are never really set in stone anyway. If you can show your prospective employers that you have the skills and experience to do the job and give a good interview, odds are you’re more likely to get hired than the candidate with a degree but without the prerequisite experience.

Instead of going to college and trusting that a degree will land you a job, invest your time in yourself: build your skills, network, and breadth of experience.

Take courses, get certified in skills employers in your line of work value, and most importantly, experiment and try to figure out what kind of work gets you fired up and what bores you to death. You’re much more likely to land a job you’re clearly informed and passionate about – and you’re far more likely to want to stay.

6. College Doesn’t Prepare You for Work

The sad truth is that college doesn’t prepare you for work because the vast majority of students graduate without having learned the hard skills or the soft skills employers want. In fact, according to research by Pearson Business School, HR professionals say that only 13% of graduates are “ready to hit the ground running” when they enter the workforce.

Information learned out of context simply because the syllabus says it’s required simply doesn’t compare to real-world experience gained by doing. Getting out into the real world and getting a job – any job – is likely to teach you far more of the practical skills you’ll need to succeed in the workplace than any classroom.

Most employers simply want to know that you offer value: that you have stellar work ethic and that you’re eager to learn. With those two qualities, you can go a long way. Any specialized skills you learn along the way will significantly increase your earning potential, and the rarer/more in demand those skills are, the more you’ll earn.

7. Colleges Tend to Take a One-Size-Fits-All Approach

Most colleges apply the same teaching approach and subject matter to all students, regardless of the individual’s interests or future career. The result: a lot of what you learn in college simply won’t be relevant or useful to you as an individual.

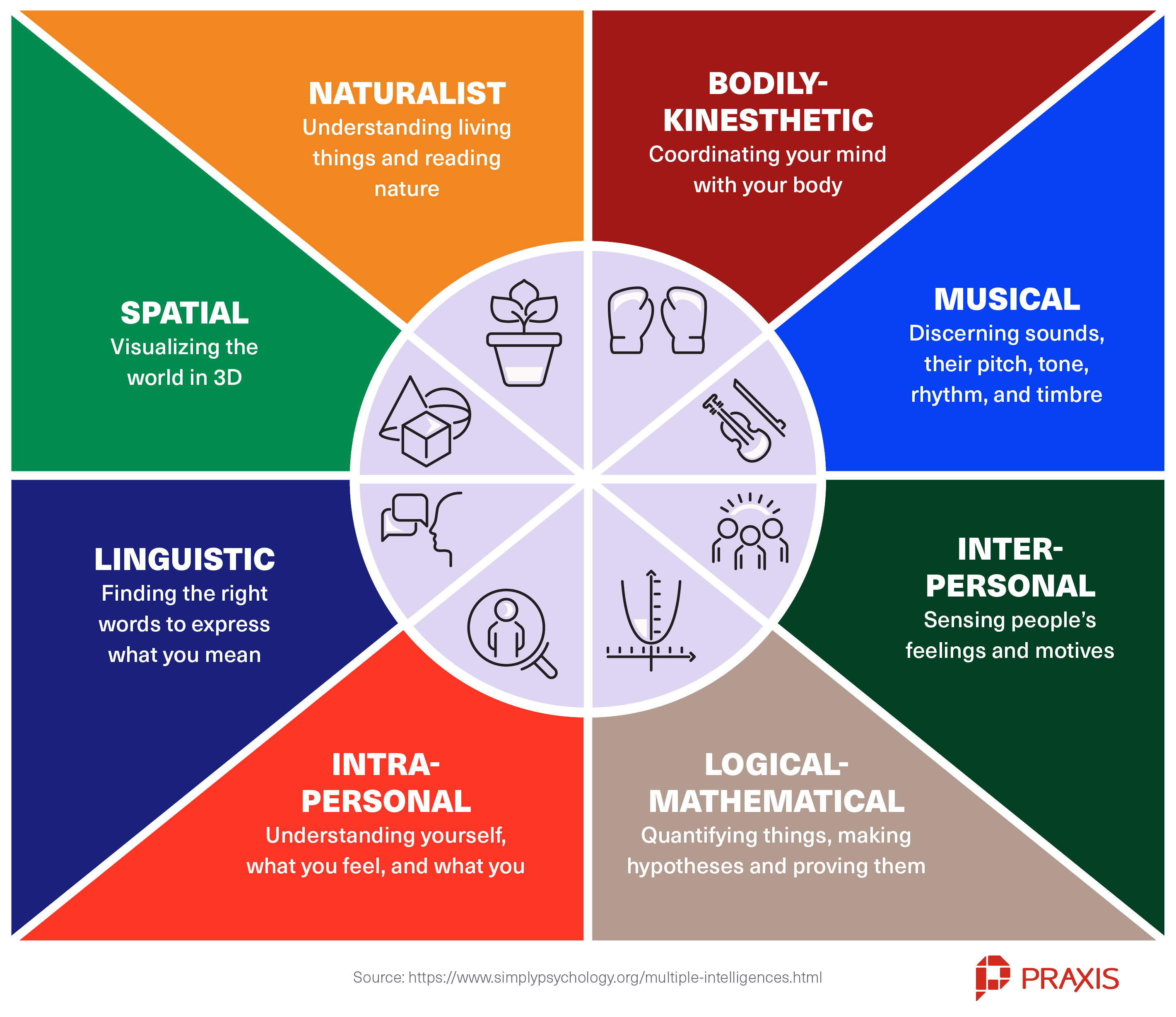

Moreover, colleges test everyone by the same standards, without taking different learning and testing abilities into consideration, which means that if you’re not entirely neurotypical, you’re at a disadvantage from the start.

In his 1983 book Frames of Mind: The Theory of Multiple Intelligences, Dr. Howard Gardner proposed a theory that there are multiple types of intelligence, namely Logical/Mathematical, Linguistic, Musical, Spatial, Bodily-Kinesthetic, Naturalist, Interpersonal, and Intrapersonal. His theory was that each individual possesses each of these “intelligences” in varying proportions, accounting for different levels of aptitude for different subjects and activities.

Whether or not Dr. Gardner’s theory is entirely accurate doesn’t matter. What is certainly true is that not everyone learns the same way or has the same capabilities or interests. Standardized testing requires everyone to be tested by the same standards, regardless of their individual aptitude. Which, when you think about it, is kind of crazy. Because how you stack up against your classmates – or some predetermined standard – is an entirely irrelevant metric for determining whether or not you’re capable of succeeding in the real world.

So… Is College Worth It?

Ultimately, only you can answer that question, but we hope we’ve helped you find some clarity. We believe that when you weigh the true costs of college – the true financial cost, the time and opportunity cost – against the dubious returns a college degree offers, the answer is a resounding NO!

A lot of people go to college to “find themselves” and figure out what they want to do with their lives (and, to some extent, to build their network). But the truth is, there are much faster, more affordable, more effective, and more certain ways to prepare yourself for the world of work, explore your interests and skills, and build a valuable professional network.

Choose Praxis, The Ultimate College Alternative

At Praxis, we believe you deserve the fastest, surest, most direct path to a career and life you love. We take a self-directed approach to learning and professional development to give self-driven individuals the tools they need to enter the business world with confidence.

We believe you shouldn’t have to spend buckets of money and years of your life on the gamble that a degree might one day lead to a job you don’t hate. You deserve better.

We believe that the best way to learn is by doing it yourself.

That’s why we’ve specifically designed our 12-month program to put you behind the wheel. In the first six months, we’ll help you identify and hone your natural interests and skills. You’ll create a personal development plan to align your strengths with foundational professional skills that will serve you for the rest of your life, and we’ll be there to mentor and coach you every step of the way.

But, it doesn’t stop there. We’ll also help you actually land your first professional opportunity. And not just any job, either. We’ll help you find and win an opportunity that lines up with your interests and skills, at a growing company. For the first six months of your new role, we’ll continue to coach and mentor you so you can get off to a running start in your career.

We’re so confident in our process at Praxis, that we stand behind it 100%. If you’re not hired within six months of completing the bootcamp, then you won’t pay a thing. Plus, you can expect to earn more than the cost in your first six months on the job – and for many participants, that means earning more than the cost of tuition before you even graduate the program.

Can’t say that about college, huh?

READ MORE: The Best Alternatives to College for 2023 and Beyond

September 11, 2020